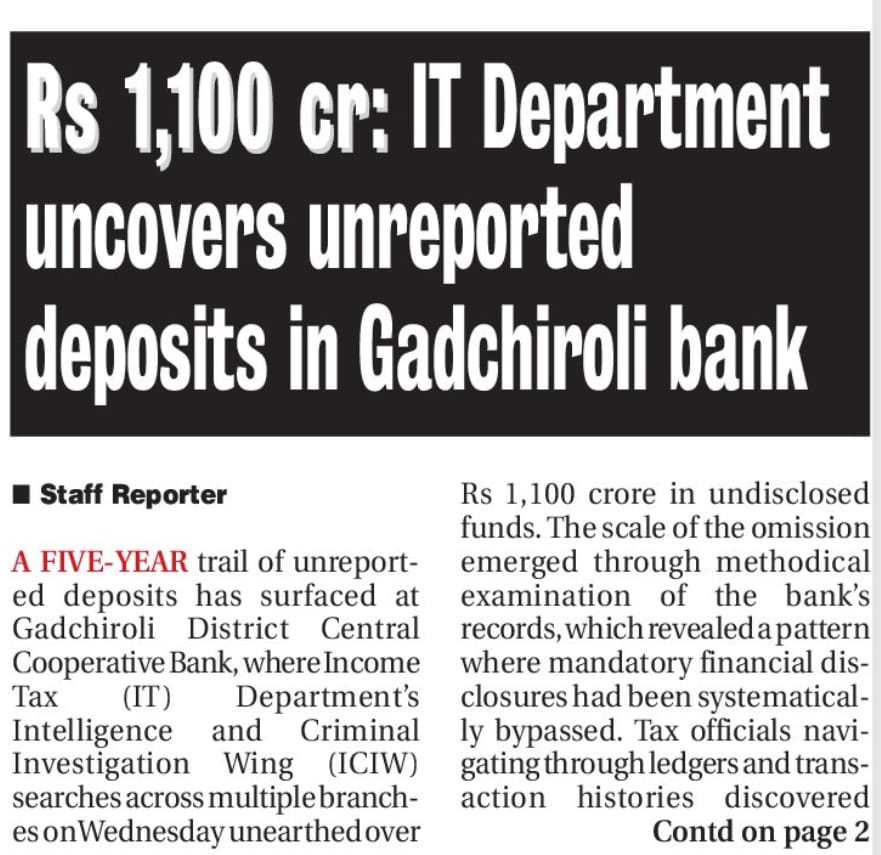

A FIVE-YEAR trail of unreported deposits has surfaced at Gadchiroli District Central Cooperative Bank, where Income Tax (IT) Department’s Intelligence and Criminal Investigation Wing (ICIW) searches across multiple branches on Wednesday unearthed over Rs 1,100 crore in undisclosed funds. The scale of the omission emerged through methodical examination of the bank’s records, which revealed a pattern where mandatory financial disclosures had been systematically bypassed. Tax officials navigating through ledgers and transaction histories discovered

Rs 300 crore in cash deposits concealed within current accounts, another Rs 600 crore tucked into savings accounts, and Rs 200 crore parked in term deposits -- all absent from the Statement of Financial Transactions (SFT) that should have flagged these movements to the department. The unreported amount stands nearly equal to the cooperative bank’s total deposits currently on its books, sources familiar with the investigation confirmed.

Banking regulations establish clear thresholds for transparency. Cash deposits aggregating Rs 50 lakh or beyond in current accounts trigger mandatory reporting through SFT mechanisms. For savings bank accounts, that ceiling drops to Rs 10 lakh. Even cheque-based deposits crossing the Rs 10 lakh mark fall within the reportable category.

Within the bank’s current accounts, IT sleuths identified individual cash deposits breaching the Rs 50 lakh mark. The savings account deposits revealed a similar pattern, with cash infusions of Rs 10 lakh or more accumulating to Rs 600 crore without corresponding disclosures. The five-year retrospective examination also indicated substantial withdrawals had occurred alongside the deposits, suggesting active circulation of unreported funds.

The Statement of Financial Transactions (SFT) mechanism operates as the Tax Department’s surveillance apparatus for high-value movements. Embedded within Section 285BA of the Income Tax Act, this framework compels specified entities -- banks, cooperative banks among them -- to illuminate transactions that might otherwise slip through the regulatory mesh.

The compliance pathway runs through electronic filings: Form 61A or Form 61B submitted by each May 31 following the financial year under scrutiny. The penalty structure escalates with delay -- Rs 500 per day initially, climbing to Rs 1,000 daily once notice periods expire. Furnishing inaccurate information carries a flat Rs 50,000 penalty, creating financial consequences designed to enforce diligence.

The scrutiny continues as tax officials assess the source trajectories of the unreported deposits and calculate potential tax liabilities arising from the five-year accumulation.

.jpeg)